eight moments

That was part of our alternative equipment sense vision. We desired our very own members, prospective people, https://paydayloanalabama.com/uniontown/ and our associates to make use of the same program. Be it a home loan application, a customers credit software, or a deposit application, i desired to have one way to obtain basic facts instead of the different options we had been using for years?.

Solution: An electronic digital-earliest way to supply consumer-very first connections?

Digital conversion process might have been banged for the overdrive within the last pair age, additionally the importance of electronic-basic banking knowledge can’t be exaggerated. Nevertheless the good history out of faith one to loan providers like Landmark Borrowing Relationship features mainly based more generations must not be underestimated both.

To help make it easy because of their participants to view a far more progressive financial experience all over products when you are prioritizing customers dating, brand new Homes chose to lender toward a partnership instead of building or to order an answer.

Partnering with Merge having Deposit Account and you will Financial has made they easy for Landmark to gain access to various choices which might be generally unavailable with strengthening or to buy by yourself. Also, a technology-driven partnership boasts versatile implementation options, powerful API integrations, and you will customizable portion.

The confluence of Landmark’s banking world options and Blend’s experience in digital framework and you may sense features translated for the significant results for one another home loan and you will put membership points.

Among the many key benefits of the blend system is that its simplistic our service build. Previously, we had manufacturers for every single of your tool set, while there was difficulty, we might need to get in touch with every one. Now i see Combine having everything therefore does not matter when it is in initial deposit membership or mortgage app. Whenever we provides a question or need help, it is that resource.

Outcome: An instant, frictionless, and you may amicable financial sense

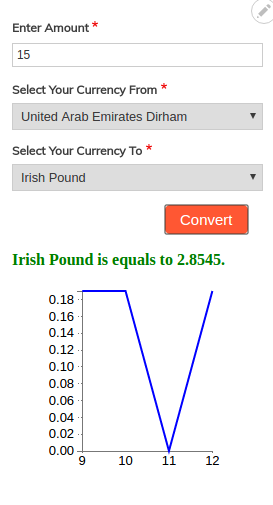

Just before following Blend’s Put Account solution, the fresh guidelines account starting procedure could take as many as eleven months all of the time. However with active, real-time integrations, the brand new Lande membership instantly inside about eight moments. Dunlop has actually noticed large alter due to their put profile choices, Our Blend put membership feel is more frictionless than the earlier provider’s try. The combination app opens accounts within a few minutes as opposed to days. In earlier times, all the app must be moved by a beneficial Landmark resource to own handling. And now, that which you happens in genuine-go out. It’s an exact same-lesson feel.

Jandris and you can Dunlop keeps noticed marked developments into the home loan front as well. Jandris said you to definitely even with meeting consumer suggestions on line very early-in the procedure, it absolutely was very guidelines it can easily need well over one or two days so you’re able to techniques. Today, Jandris told you, That have Merge, a debtor is also done home financing software in an hour or so, with the suggestions they need, all the paperwork, and all the verifications.

In total, Landmark professionals was indeed in a position to rescue more than 9,000 manual instances of control time. Since the Dunlop pointed out, The alteration with the Blend put membership application has increased our efficiency and you will lets all of our user provider center to focus its go out helping users in place of processing programs.

A different aches point new House was actually seeking address is having less an alternative services that will be used across all the factors. Now, no matter whether it is in initial deposit account otherwise a home loan software, each other Jandris and you may Dunlop accept that Landmark employees appreciate which have that source for every investigation.

Blend’s Financial Collection makes it possible for financing officials in order to efficiently use investigation things, from 1st visitors involvement through closure. This new user-friendly application feel preserves LOs day, but it also makes the overall software feel better having borrowers too.

Trying the future

Landmark happens to be moving in order to Combine Builder, and you will centered on Jandris, We have been excited about the mixture Builder program since it is supposed to allow me to configure the program way to remain appointment our very own members’ demands. On the build-versus-buy- versus-companion issues, one of the greatest advantageous assets to banks and you can borrowing from the bank unions partnering which have technical organizations such as for example Blend is the fact it opens this new possibility of a lot of time-title cooperation.

Jandris informed me you to definitely, Whenever we remember Landmark’s vision and you will whatever you have left to complete making it simple for all of our members to activate with our company, the combination partnership makes it simple for me to vie for the total experience – in addition to the tool. And with intentions to add signature loans, house collateral fund, and you may playing cards by way of Blend, it appears as though Landmark Credit Connection and you can Merge gets the new chance to continue collaborating well for the future.